Common VA & FHA Loan Questions—Answered the LoanGoal Way

At www.loangoal.com, we speak with homebuyers every day who were told “no” elsewhere—often incorrectly. VA and FHA guidelines are far more flexible than many lenders admit, especially when manual underwriting is applied correctly.

Below are the most common VA and FHA questions we receive, answered based on actual VA and HUD guidelines, not lender overlays.

VA LOAN QUESTIONS (LOANGOAL ANSWERS)

Q: Who qualifies for a VA home loan?

LoanGoal Answer:

VA loans are available to eligible veterans, active-duty service members, National Guard and Reserve members, and certain surviving spouses. At LoanGoal, we help borrowers obtain and review their Certificate of Eligibility (COE) and explain how entitlement works—including reuse of benefits.

Q: Do VA loans really require no down payment?

LoanGoal Answer:

Yes. VA loans allow 100% financing with no monthly mortgage insurance. At LoanGoal, we regularly close VA loans with zero down payment, even in competitive markets, as long as the appraisal supports the purchase price.

Q: What credit score does LoanGoal require for a VA loan?

LoanGoal Answer:

The VA itself does not set a minimum credit score. LoanGoal follows true VA guidelines and evaluates the entire financial profile, not just a score. We routinely help borrowers who were denied elsewhere due to unnecessary credit overlays.

Q: Can LoanGoal help with VA loans under 580 credit?

LoanGoal Answer:

Yes. LoanGoal specializes in manual underwriting for VA loans, which allows approvals for borrowers with lower credit scores when income, residual income, and payment history support the loan. Many of our VA borrowers come to us after another lender said no.

Q: Why was my VA loan denied by another lender?

LoanGoal Answer:

Most denials are caused by lender overlays, not VA rules. Many lenders impose higher credit score requirements, tighter DTI limits, or refuse manual underwriting. LoanGoal removes those barriers by underwriting to actual VA standards.

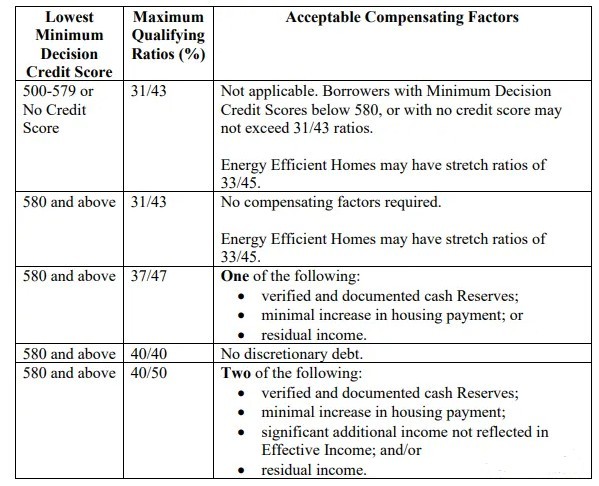

Q: Does LoanGoal approve VA loans with high DTI?

LoanGoal Answer:

Yes—when supported by strong residual income, which is the VA’s primary concern. We routinely approve VA loans with DTIs above 50% when residual income guidelines are met.

Q: Can sellers pay closing costs on VA loans?

LoanGoal Answer:

Yes. VA loans allow seller-paid closing costs and concessions. LoanGoal structures VA offers strategically to minimize out-of-pocket expenses for buyers whenever possible.

Q: What is the VA funding fee and does LoanGoal help with waivers?

LoanGoal Answer:

The VA funding fee helps keep the program running and can be financed into the loan. Veterans receiving VA disability compensation—and certain surviving spouses—are exempt, and LoanGoal ensures eligible borrowers receive that waiver.

FHA LOAN QUESTIONS

Q: What credit score does LoanGoal require for FHA loans?

LoanGoal Answer:

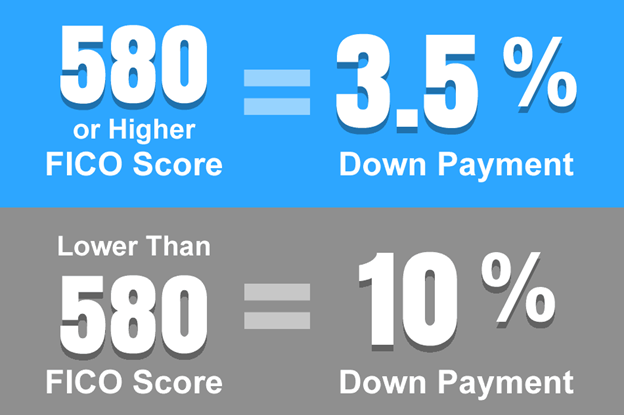

FHA guidelines allow:

- 580+ credit score with 3.5% down

- 500–579 credit score with 10% down

LoanGoal works within true FHA guidelines and assists borrowers who don’t fit rigid automated approval models.

Q: Can LoanGoal help with FHA loans under 580 credit?

LoanGoal Answer:

Yes. LoanGoal regularly closes manual underwrite FHA loans, which are ideal for borrowers with lower credit scores, limited credit history, or recent credit events.

Q: Are FHA loans only for first-time buyers?

LoanGoal Answer:

No. FHA loans are available to repeat buyers as well. LoanGoal helps buyers use FHA financing for primary residences even if they’ve owned homes before.

Q: Can I qualify for FHA with collections or charge-offs?

LoanGoal Answer:

Often, yes. FHA does not require all collections to be paid, and many charge-offs can remain unpaid depending on the borrower’s overall profile. LoanGoal reviews each situation individually rather than applying blanket rules.

Q: How soon after bankruptcy can LoanGoal approve FHA loans?

LoanGoal Answer:

FHA allows:

- Chapter 7: as little as 2 years

- Chapter 13: possible during repayment with court approval

- Foreclosure: typically 3 years

LoanGoal frequently helps borrowers re-enter homeownership sooner than expected.

Q: Does FHA allow gift funds for down payment?

LoanGoal Answer:

Yes. FHA allows 100% of the down payment to come from approved gift sources, such as family members. LoanGoal handles documentation to ensure compliance.

Q: What property types does LoanGoal finance with FHA loans?

LoanGoal Answer:

LoanGoal finances FHA loans for:

- Single-family homes

- FHA-approved condos

- Duplexes, triplexes, and four-unit properties (owner-occupied)

WHY LOANGOAL IS DIFFERENT

Many lenders rely solely on automated approvals and overlays. LoanGoal focuses on:

- Manual underwriting

- VA & FHA guideline accuracy

- Lower credit score approvals

- Second opinions after denial

- Nationwide lending

If you’ve been told “you don’t qualify”, the real answer may be you just spoke to the wrong lender.

FINAL THOUGHTS

VA and FHA loans were designed to help people become homeowners—not to block them with unnecessary restrictions. Understanding the real rules matters.

At LoanGoal, we believe borrowers deserve clear answers, honest guidance, and underwriting that follows the actual program guidelines.

Have questions or need a second opinion?

LoanGoal specializes in VA and FHA loans others won’t touch.

Reach out anytime—we’re here to help.