VA Home Loans for Veterans with Low Credit: Real Approval Options That Actually Work

If you’ve searched online for VA loan help and keep seeing the same generic advice — “you need a 620 credit score” or “try improving your credit first” — you’re not alone. The truth is, many veterans qualify for a VA home loan even with a low credit score, but they get turned away because…

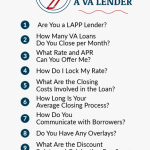

Read MoreVA Home Loan Questions Veterans Are Asking in 2026 — Honest Answers from a VA Loan Specialist

Buying a home with a VA loan in 2026 is still one of the most powerful benefits available to veterans and active-duty service members. Yet many VA buyers are confused, misinformed, or even denied — not because of VA rules, but because of lender overlays. At LoanGoal.com, powered by Access Capital Group, we specialize in…

Read MoreBuying a Home with a VA Loan in 2026: What Veterans Should Really Know

Buying a home with a VA loan in 2026 remains one of the strongest benefits available to eligible service members, veterans, and surviving spouses. Yet many veterans are still misinformed — or even denied — because lenders apply rules the VA never created. At LoanGoal.com, powered by Access Capital Group, we specialize in VA loans…

Read MoreMortgage Rates in 2026: Why This Market Is Creating New Opportunities for Homebuyers and Homeowners

Mortgage rates are starting 2026 with encouraging signs — and for homebuyers and homeowners alike, this market is opening doors that many thought were closed just a year ago. While rates remain higher than the historic lows of the pandemic years, they are now trending in a direction that gives buyers more confidence, sellers more…

Read MoreLooking Ahead: 2026 Mortgage Trends and New Year Wishes from Access Capital Group

Happy New Year! As we enter 2026, the LoanGoal team at Access Capital Group would like to thank you for your continued trust. We’re excited about the opportunities ahead, including higher 2026 loan limits, the potential for lower interest rates, and a growing supply of homes. Now is a great time to plan, and we’re here…

Read More2026 Zero Down VA home loans with NO upper Loan Limits

Started in 2020 VA will no longer require a down payment on a house because the value is higher than the conforming loan limit. Zero Down VA loans NO loan limit Jan 1st 2020. Jan 1st 2026 the conforming VA loan limit is $832,750. You can have a VA zero down loan over $832,750, it…

Read More2026 Loan Limits for FHA Mortgages

2026 Loan Limits for FHA Mortgages The new forward mortgage loan limits in the table below are effective for FHA case numbers assigned on or after January 1, 2026. Notably, the maximum loan limits for FHA forward mortgages will rise in 3,151 counties. Property Size Low-Cost Area “Floor” High-Cost Area “Ceiling” Alaska, Hawaii, Guam, and…

Read More2026 Loan Limits for Conventional Mortgages

Conventional – Loans closed on or after Jan 1st 2026: The Federal Housing Finance Agency (FHFA) has issued the following maximum first mortgage loan limits that will apply to conventional loans for acquisition by Fannie Mae / Freddie Mac with a note date on and after January 1, 2026. 2026 Conventional Loan Limits Units Conforming…

Read MoreCommon VA & FHA Loan Questions—Answered the LoanGoal Way

At LoanGoal.com, we speak with homebuyers every day who were told “no” elsewhere—often incorrectly. VA and FHA guidelines are far more flexible than many lenders admit, especially when manual underwriting is applied correctly. Below are the most common VA and FHA questions we receive, answered based on actual VA and HUD guidelines, not lender overlays.…

Read MoreExpert Answers to Your VA Home Loan Questions & The Power of Manual Underwriting

Are you a Veteran or active-duty service member looking to use your home loan benefit in 2025? Whether you’re in Texas, Florida, California, or anywhere across the U.S., the rules for VA home loans are more flexible than many realize. At Access Capital Group, Inc., we receive daily questions from borrowers nationwide who have been told…

Read More